News Flash

News Flash

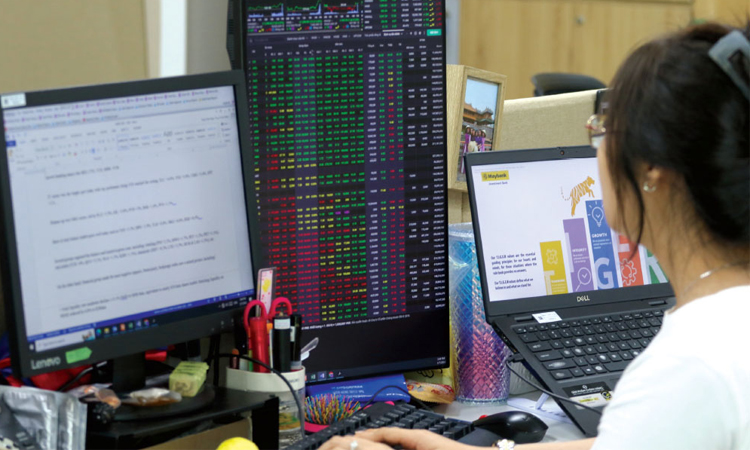

HANOI, Oct 8, 2025 (BSS/AFP) - Vietnam was designated an emerging market by a major index provider for the first time on Wednesday, a long-awaited upgrade that could accelerate foreign investment into one of Southeast Asia's fastest growing economies.

FTSE Russell is reclassifying Vietnam as a "secondary emerging market", a designation that will put it in the same group with China and India when it takes effect in September next year, the index provider said.

The upgrade from "frontier" status, which is subject to an interim review in March, comes as Vietnam's benchmark stock index has soared over 30 percent in the last year.

"FTSE Russell recognises the progress made by the Vietnamese market authorities in evolving its market... and establishing a formal process for handling failed trades," the company said.

The index provider first added Vietnam to its watch list for an upgrade in 2018, and the country has made sweeping market reforms since then, including scrapping some foreign ownership caps for publicly listed companies.

It earlier predicted that promotion to emerging market status could unlock up to $6 billion in capital inflows.

Vietnam's State Securities Commission said Wednesday that the designation was "an important milestone marking the strong development of the Vietnamese stock market".

It also vowed to continue to "create maximum conditions for domestic and foreign investors to access the market... while promoting deeper integration into the global financial market".

The country's economy grew 7.1 percent last year and is aiming for eight percent this year as it vies for "middle-income country" status by 2030.

However, the International Monetary Fund last month projected growth to slow to 6.5 percent this year and "decelerate further in 2026 given the full year effect of the new US tariffs".

Under a trade deal between Hanoi and Washington announced earlier this year, the Southeast Asian manufacturing hub negotiated levies on its exports to the United States down from 46 percent to a minimum 20 percent in return for opening its market to US products.