News Flash

News Flash

LONDON, Nov 19, 2025 (BSS/AFP) - Britain's annual inflation rate slowed in October, official data showed Wednesday, providing some relief to the struggling Labour government one week before unveiling its latest budget.

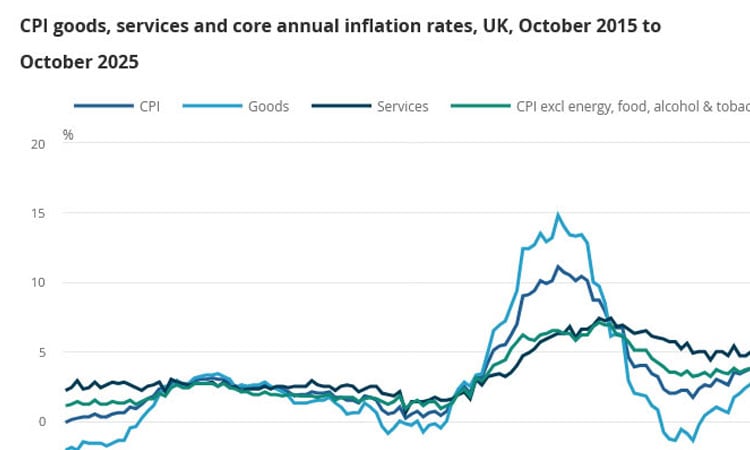

The Consumer Prices Index rose by 3.6 percent over 12 months, down from 3.8 percent in September, the Office for National Statistics (ONS) said in a statement.

The annual budget on November 26 is set to feature tax rises as Labour, badly trailing in polls, seeks to drive down government debt and fund investment in public services.

- 'Good news' -

"This fall in inflation is good news for households and businesses across the country, but I'm determined to do more to bring prices down," finance minister Rachel Reeves said in a statement.

"That's why at the budget next week I will take the fair choices to deliver on the public's priorities to cut NHS (National Health Service) waiting lists, cut national debt and cut the cost of living," she added.

The ONS said inflation's slowdown in October, in line with most analyst expectations, was driven mainly by gas and electricity prices rising less than a year earlier.

This was partially offset by rising food prices.

Analysts said the drop to inflation would likely see the Bank of England (BoE) cut its main interest rate in December, although its next policy decision could depend also on what the budget delivers.

Wednesday's data follows official figures last week that showed Britain's economy slowed in the third quarter, when unemployment rose.

Prime Minister Keir Starmer's Labour party has struggled to consistently grow the UK economy since returning to power in July 2024 following 14 years of Conservative party rule.

Many economists blame the weak growth largely on a decision by Reeves to increase a tax on businesses in her first budget last year.

"All eyes now turn to the budget" next week, noted Isaac Stell, an analyst at investment manager Wealth Club.

"With the expected fiscal tightening in the form of tax rises a foregone conclusion, policymakers at the BoE will be watching closely to see how these measures affect growth and demand.

"The Bank of England stands ready to deliver a pre-Christmas rate cut... and the consumer will be able to raise a glass to that."

It kept its main rate at 4.0 percent earlier this month, with BoE governor Andrew Bailey insisting that the central bank needed to see more evidence of the UK annual inflation rate returning to its two-percent target.

Britain's retail banks tend to pass on BoE rate cuts to their customers, easing the cost of mortgages and business loans.