DHAKA, July 25, 2020 (BSS) – Experts in an online discussion

yesterday have said banks and financial institutions along with the

government should invest properly to attain sustainable economic

goals, SDGs by 2030.

They also called for involving the backward, lagging behind, and

deprived people more in economic activities.

They were addressing the discussion on “the role of financial

institutions in achieving SDGs” organised by Bangladesh Leasing and

Finance Companies Association (BLFCA) and Banik Barta, a leading

national daily, said a press release.

PKSF Chairman Qazi Kholiquzzaman Ahmad, former Principal Secretary

to Prime Minister’s Office Md. Abdul Karim, also Senior Adviser of

BRAC and chairman of IPDC Finance Ltd, Bangladesh Bank DFIM Executive

Director Md. Shah Alam, and Director (Training) of BIBM Professor Shah

Md. Ahsan Habib were discussants at the meeting.

BLFCA Chairman, also Managing Director and CEO of IPDC, Mominul

Islam gave the introductory speech while BLFCA First Vice Chairman

Golam Sarwar Bhuiyan, also MD and CEO of IIDFC made the closing

remarks.

Qazi Kholiquzzaman said improved living standards, multifaceted

poverty reduction, gender equality, employment, inclusive investment

based on equality, and proper use of resources are to be ensured by

achieving economic development, one of the three indicators the SDG.

Banks, financial institutions, microfinance institutions, insurance

sector and capital market need to play an effective role beside the

government to implement these.

He said people those who are lagging behind and deprived should be

given priority. Besides, the new impoverished community created by the

corona situation are needed to be taken forward through rapid economic

cooperation, he said.

Abdul Karim pointed out that the main challenge before achieving the

SDGs is inadequate funding.

He said Financial institutions should come forward to invest in

cottage-small-medium industries, empowering women, forming social

funds for human resource and health sector development, and

implementing environment-friendly projects.

Banks and financial institutions need to play a stronger role in the

economic revival at post-corona period by expediting various financial

incentives announced by the government.

In the introductory speech, Mominul Islam said, “Corona made the

achieving of SDGs more challenging than ever. Hence, everyone needs to

be more focused on their goals from respective places. We need to put

more emphasis on economic recovery.”

“Financial institutions, in future, will work more closely with

government initiatives to achieve the goals,” he said, adding that

those institutions that incorporated sustainable development into

their business strategies became more financially successful.

Md. Shah Alam highlighted the inclusive and environment-friendly

projects implemented by various non-bank financial institutions in the

country and described various policy support and financial assistance

provided by Bangladesh Bank regarding this.

He said the entire financial sector rather than a few banks or

financial institutions should work for sustainable economic

development.

“Bangladesh Bank will be ready to provide all necessary assistance

if any organisation comes forward with an innovative project for the

socio-economic development of the country,” he added.

Shah Md. Ahsan Habib said financial institutions need policy support

to achieve sustainable economic goals.

“Some financial institutions have done better than banks in

sustainable development, while irregularities and corruption by some

institutions have severely damaged the reputation of the sector,” he

said, adding that leaders of the sector should play a strong role to

check these irregularities.

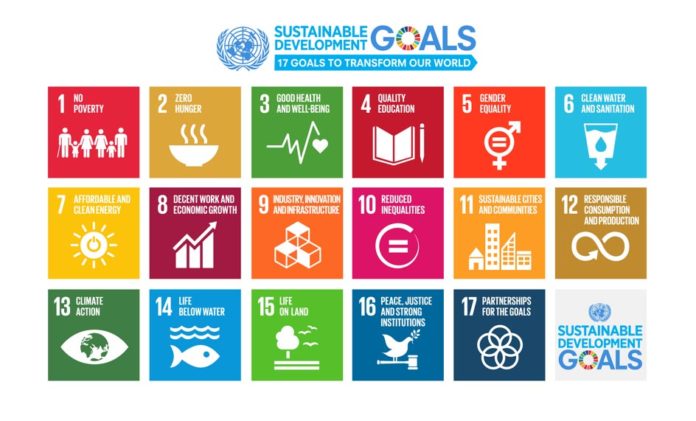

Mentionable, deadline for achieving the SDGs is the year 2030. Only

10 years remained to meet the set goals. A total of 169 targets at 17

sectors including eradication of poverty, inequality and hunger have

to be met by this time.