HONG KONG, Sept 11, 2019 (BSS/AFP) – Asian markets mostly rose on Wednesday

with a broadly upbeat tone across trading floors ahead of major meetings at

the European and US central banks, while there is also a growing sense of

optimism over China-US trade talks.

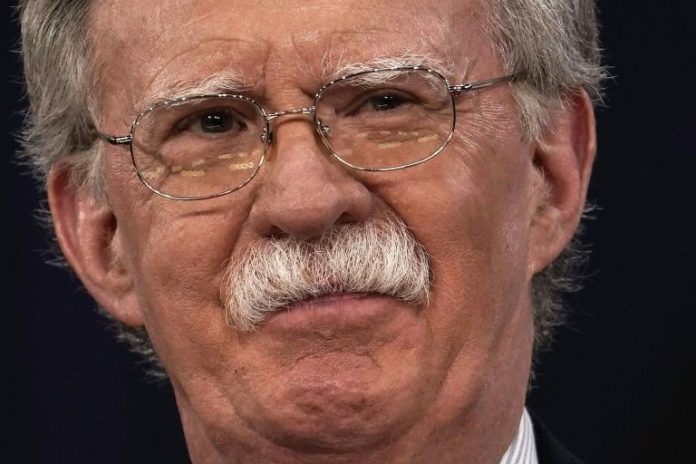

News that Donald Trump had fired his fervently hawkish national security

adviser also lifted sentiment with analysts saying it could see the White

House take a less strident approach and ease geopolitical tensions.

With the global economy stuttering attention has turned increasingly to

central banks as investors look for more stimulus.

On Thursday the European Central Bank holds one of its most anticipated

gatherings and hopes are for a series of fresh measures including a possible

interest rate cut, fresh bond-buying quantitative easing (QE) or other

loosening tools.

That is followed by the Federal Reserve’s board meeting next week, where it

is tipped to announce another reduction in borrowing costs as the world’s top

economy — which has so far been the strongest globally — stutters.

“With the expectation of the resumption of quantitative easing by the

ECB… and a rate cut by the Federal Reserve next week, the risk environment

has solidified and tempted investors out of hiding from the bond markets and

back into equities,” said Jeffrey Halley, senior market analyst at OANDA.

In early trade Hong Kong was up 0.4 percent, while Tokyo finished the

morning 0.6 percent higher and Singapore put on 0.4 percent. Seoul rose 0.5

percent, Sydney and Taipei each added 0.2 percent, while Manila and Jakarta

posted gains.

However, Shanghai was marginally lower and Wellington tumbled more than one

percent as Prime Minister Jacinda Ardern’s government was rocked by its

handling of sexual assault allegations against a top Labour Party staffer.

Dealers are also awaiting the latest developments in trade talks between

China and the US ahead of next month’s planned top-level meeting, with both

sides sounding less terse in recent statements, which has lifted hopes.

– Lower war-risk premium –

Trump’s decision to sack John Bolton as leading security adviser raised the

possibility of an easing of tensions between the US and several nations,

particularly Iran.

The controversial Bolton was closely linked to the invasion of Iraq and

other past aggressive US foreign policy decisions, and was seen as one of the

main driving forces in Trump’s muscular approach to Tehran, North Korea and

Venezuela, among others.

Stephen Innes at AxiTrader said that while the move did not necessarily

mean a huge change in policy direction, “it does eliminate the most vocal

advocate for US military-enforced regime change in the Trump administration”.

He added that “from a geopolitical risk perspective, it does lessen war

risk premiums, especially in Syria, Venezuela, and Iran and opens the door to

more friendly discussion with North Korea”.

However, the possibility of a dialling down in the stand-off between the US

and Iran led to a plunge Tuesday in the price of oil, with WTI diving almost

three percent from an intraday high and Brent shedding 2.5 percent.

The two contracts later clawed back some of the losses on bargain-buying

expectations for more output cuts by leading producers led by Saudi Arabia.

In share trading companies linked to Apple enjoyed healthy buying after the

US tech giant unveiled new iPhones, including a lower-priced offering, and

set launch dates for its original video offering as well as its game

subscription service.

In Tokyo, Alps Alpine surged three percent, Japan Display put on nearly

three percent and Sharp rallied more than four percent, while LG Display in

Seoul was up two percent in Seoul. Taipei-listed Foxconn rose 0.2 percent.

On forex markets the pound held its recent gains as Prime Minister Boris

Johnson said he was pushing to strike a divorce agreement with the European

Union, having lost a series of key votes to MPs opposed to a no-deal Brexit.

– Key figures around 0230 GMT –

Tokyo – Nikkei 225: UP 0.6 percent at 21,514.14 (break)

Hong Kong – Hang Seng: UP 0.4 percent at 26,784.99

Shanghai – Composite: FLAT at 3,020.13

Pound/dollar: DOWN at $1.2348 from $1.2357 at 2050 GMT

Euro/pound: UP at 89.47 pence from 89.37 pence

Euro/dollar: UP at $1.1047 from $1.1042

Dollar/yen: UP at 107.64 yen from 107.53 yen

West Texas Intermediate: UP 45 cents at $57.85 per barrel

Brent North Sea crude: UP 40 cents at $62.78 per barrel

New York – Dow: DOWN 0.3 percent at 26,909.43 (close)

London – FTSE 100: UP 0.4 percent at 7,267.95 (close)