PARIS, Jan 13, 2019 (BSS/AFP) – Europe is giving US-led calls for a

boycott of Huawei 5G telecoms equipment a mixed reception, with some

governments untroubled by spy suspicions against the Chinese giant, but

others backing a ban.

In the latest setback for Huawei, Poland said Friday it had arrested a

Chinese telecoms executive suspected of spying for China, with local media

identifying him as a Huawei director.

On Saturday Huawei said it had fired the employee arrested in Poland,

telling AFP “his alleged actions have no relation to the company”.

Huawei had already seen the arrest of the daughter of the firm’s founder

in Canada and US efforts to blacklist the company internationally over

security concerns.

Several Asian and Pacific countries have followed Washington’s call for a

Huawei ban, but the picture in Europe is more nuanced, not least because

Huawei’s 5G capabilities are so attractive. They are well ahead of Sweden’s

Ericsson, Finland’s Nokia and South Korea’s Samsung, analysts say.

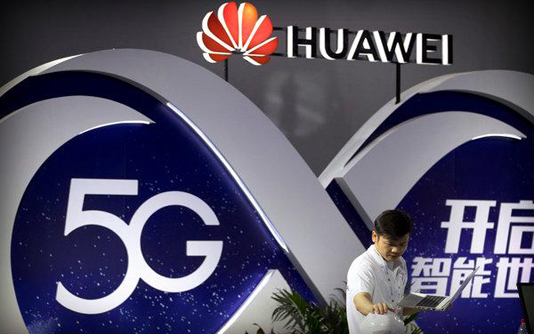

Fifth generation (5G) technology represents a quantum leap in wireless

communication speed, and will be key to developing the internet of things,

including self-driving cars. That is why Europe wants to deploy it as quickly

as possible.

“Operators have looked at alternatives but have realised that Huawei is

currently more innovative and probably better for 5G,” said Dexter Thillien,

an analyst at Fitch Solutions.

– ‘Competence’ and ‘talent’ –

Huawei has faced increasing scrutiny over its alleged links to Chinese

intelligence services, prompting not just the US but also Australia and Japan

to block it from building their 5G internet networks.

But in Europe, Portugal’s main operator MEO signed a deal with Huawei in

December during a visit by Chinese President Xi Jinping, praising the Chinese

company’s “know how, competence, talent and capacity to develop technology

and invest in our country”.

By contrast Norway, whose current networks are for the most part made up

of Huawei equipment, is thinking of ways to reduce its “vulnerability”,

according to the Nordic country’s transport and communications minister

quoted in the local press — especially towards countries with whom Oslo “has

no security cooperation”, an implicit reference to China.

Britain’s Defence Secretary Gavin Williamson meanwhile said he had “grave,

very deep concerns about Huawei providing the 5G network in Britain”.

The Czech cybersecurity agency said that Chinese laws “force private

companies with their headquarters in China to cooperate with intelligence

services”, which could make them “a threat” if involved with a country’s key

technology.

– ‘Expensive but better’ –

Germany is under pressure from Washington to follow suit, news magazine

Der Spiegel reported. But the country’s IT watchdog says it had seen no

evidence Huawei could use its equipment to spy for Beijing.

Meanwhile, telecom operators across Europe, under heavy pressure to roll

out 5G quickly, seem to be playing down security fears because using Huawei

makes business sense to them.

“Huawei is much more expensive today than its competitors but it’s also

much better,” said a spokesperson at a European operator who asked not to be

named because of the sensitive nature of the matter. The quality of Huawei’s

equipment “is really ahead” of its European competitors, he added.

Furthermore, “everywhere in Europe, operators are the target of huge

controls in that area and Huawei’s equipment has never been found to be at

fault”.

To add to the confusion, large operators could reject Huawei equipment in

some of their markets, but not in others.

Historic French operator Orange has said that it won’t use Huawei networks

in France, but could very well do so in Spain and Poland.

– High stakes in Europe –

Germany’s Deutsche Telekom announced a deal with Huawei for its future 5G

network in Poland, but hasn’t said what it will do in Germany itself.

Meanwhile, Huawei is making great efforts to prove its good faith. It has

opened test labs for its equipment in Germany and the UK in cooperation with

the governments there, and is to launch another in Brussels by the end of the

first quarter.

The stakes are high: Europe is a crucial market for Huawei, whose combined

sales for Europe, the Middle East and Africa accounted for 27 percent of

overall group sales in 2017, mostly thanks to spending by European operators.

Huawei rotating chairman Guo Ping in late December complained that his

company was being subjected to “incredibly unfair treatment”.

“Huawei has never and will never present a security threat,” Guo wrote in

a New Year’s message to staff.

Some analysts doubt that even a widespread ban on Chinese telecoms

networks equipment could possibly guarantee watertight security.

“In Paris alone, there are more than a million Huawei smartphones. If you

want to listen in, that’s how many opportunities you have,” said a sector

specialist.